Trump’s Tariff Formula: Turning Trade Deficits into Economic Penalties

The sharp increase in U.S. tariffs during Donald Trump’s presidency did not only target rivals, but also shook the foundations of global trade, affecting allies alike. Behind this aggressive policy wasn’t a complex set of trade agreements or negotiations, but rather a surprisingly simple formula: converting trade deficits into tariff rates.

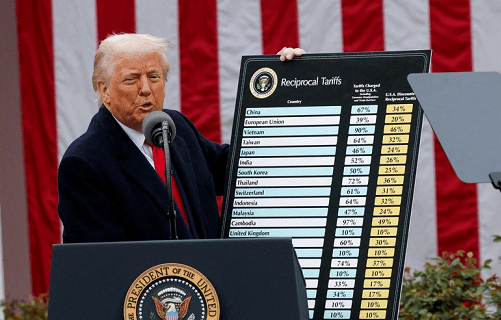

According to British economist Michael Roberts, the Trump administration’s approach had little to do with actual tariffs, subsidies, or non-tariff barriers imposed on U.S. goods. Instead, it relied on a numerical calculation: the U.S. trade deficit with a country was divided by the total value of U.S. imports from that country, and the result was then halved to determine the tariff rate.

Vietnam provides a striking example. The U.S. imports $137 billion worth of goods from Vietnam, while exporting only $14 billion. That’s a 90% deficit. Based on the formula, a 45% tariff was imposed. Yet, Vietnam does not levy a 90% tariff on American goods. So this “penalty” has no basis in economic reality—it’s purely arithmetic.

This logic doesn’t only hit Vietnam but also many low-income countries across Southeast and South Asia. Nations like Cambodia and Sri Lanka are particularly vulnerable, yet Trump’s tariffs deal them an economic blow under the same formulaic logic.

But one major omission stands out: the services sector. While services make up about 20% of global trade, they remain untouched. The U.S. runs a goods trade deficit with the EU, prompting Trump to impose a 20% tariff. However, in services—such as banking, insurance, software, and professional consulting—the EU runs a sizable deficit with the U.S. Had services been included, the U.S.–EU trade gap would nearly disappear.

Another case is the United Kingdom. Although U.S.–UK goods trade is nearly balanced—$58 billion in imports vs. $56 billion in exports—the UK is still hit with a flat 10% tariff. When services are factored in, the tariff rate would rise to 20%. Morgan Stanley estimates that this could reduce UK economic growth by as much as 0.6 percentage points.

Ultimately, it’s the American consumer who will bear the brunt. Roberts warns that higher import costs will hit essential goods—especially those not produced domestically—impacting lower-income households the hardest. U.S. industry, too, will face rising costs for intermediate goods, machinery, and equipment, outweighing any benefit from reduced foreign competition.

The most dramatic example is China. A 54% tariff could slash imports by $507 billion, potentially cutting total U.S. imports by 20%—a shock akin to that experienced during the pandemic. Roberts warns this could trigger a new recession or fuel inflation in the U.S.

Retaliatory tariffs from other countries are also inevitable. Roberts points to the 1930s Smoot-Hawley tariffs, which prompted global retaliation and a 33% drop in U.S. exports—leading to what’s now called the “Kindleberger Spiral” of collapsing international trade.

Back then, global trade fell from $3 billion in January 1929 to $1 billion by March 1933. Today, the stakes are even higher. Trade now represents 15% of U.S. GDP—three times its share in 1929. The economic impact of a trade war in 2024 could be far more severe.

UBS predicts that U.S. real GDP could drop by 1.5–2 percentage points this year if tariffs aren’t reversed, with inflation approaching 5%.

Roberts concludes his analysis with a warning: “Falling trade growth due to tariffs will also slow international capital flows, reducing investment and weakening global economic growth.”

- Tension Between Donald Trump and Elon Musk: Is a Major Crisis Beginning in the American System? - June 6, 2025

- Harvard Faces Federal Funding Freeze Over Alleged “Disrespect to the Nation,” Says McMahon - May 6, 2025

- Tariffs, Troubles, and Transition: A Tumultuous Week for the U.S. and NYC Economy - May 6, 2025